---

## Notes

[[My FIRE plans]]

## Highlights

- [[Early retirement conditions are different than traditional retirement]]

### Benefits

Having this discretionary withdrawal strategy seems to solve a lot of the problems I see with full FI:

- It encourages you to focus on reducing your fixed costs (i.e. the expenses that really matter) but lets you relax with your fun/discretionary spending.

- In down years, you’re forced to reevaluate your discretionary spending (so you don’t just keep mindlessly spending on things that you may not provide value anymore)

- It gives you a pot of money specifically for discretionary spending, so you’ll hopefully be more likely to spend on fun things (rather than just keep saving and saving, like I did).

- When you reach your number, you have enough to do “anything” but not enough to do “nothing” (unless you’re happy with $0 of discretionary spending during bear markets).

- Money is still a motivating factor in your life, because you may want to have some income coming in during down years

- Since your spending/lifestyle is changing year-to-year, you’ll hopefully appreciate things more (rather than just get into a routine of spending/doing the same things) ([View Highlight](https://read.readwise.io/read/01h2c8gs85hcxy5qhe96rkya28))

### Rules

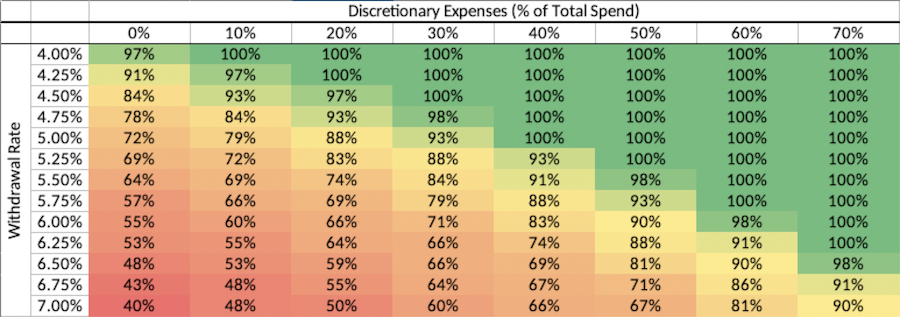

First, figure out the percentage of your spending that goes towards discretionary expenses.

Discretionary expenses are any expenses you feel you could do without, if necessary. ([View Highlight](https://read.readwise.io/read/01h2c791byc7zst4q3r64469hr))

Once you have your discretionary spending percentage, find it on the following table and then pick a comfortable success rate in that column to find your withdrawal rate ([View Highlight](https://read.readwise.io/read/01h2c799m03m66arwnje6e6v5k))

([View Highlight](https://read.readwise.io/read/01h2c7v9966revhvrn4wq2c2n6))

some simple rules you have to follow for this strategy to work:

1. While in a bear market (>20% off of highs), withdraw $0 for discretionary spending

2. When the market is in a correction (>10% below highs), withdraw 50% of your discretionary budget

3. All other times, withdraw your entire discretionary budget ([View Highlight](https://read.readwise.io/read/01h2c7a6ymhw0fp502evq3xw96))

after a year of 5% inflation, this person would withdraw $28,875 for their essential expenses and then either $27,500, $13,750, or $0 for their discretionary expenses (depending on the past year’s market performance). ([View Highlight](https://read.readwise.io/read/01h2c7z0gsw3vzw7417kwzfj8t))